Return on Assets Ratio Formula

The average of total assets should be used based on the period being evaluated. Return on capital employed formula is calculated by dividing net operating profit or EBIT by the employed capital.

Return On Total Asset Ratio Formula Examples Calculation Youtube

It is very easy and simple.

. This shows that for every 1 of assets that Company Anand Ltd has they have 075 of debt. Return on assets ROA is a ratio that tells you how much of a profit a company earns from its resources and assets. Return on average assets can be calculated with the following formula.

We can calculate Debt Ratio for Anand Ltd by using the Debt Ratio Formula. Some prefer to take net income as the numerator and others like to put EBIT where they dont want to consider the interests and taxes. EB Cost of equity capital PG HA Return on assets ROA Net Income Interest expense 1-tax rate Average total assets Overall profitability of assets.

Activity ratios measure a firms ability to convert different accounts within its balance sheets into cash or sales. The distinct difference between return on assets and asset turnover is that. This ratio can also be represented as a product of the profit margin and the total asset turnover.

Return On Net Assets - RONA. Return on Equity ROE is the ratio that mostly concerns shareholders management teams and investors in. Return on equity ROE Net income Average total shareholders equity Profitability of all equity investors investment Benchmark.

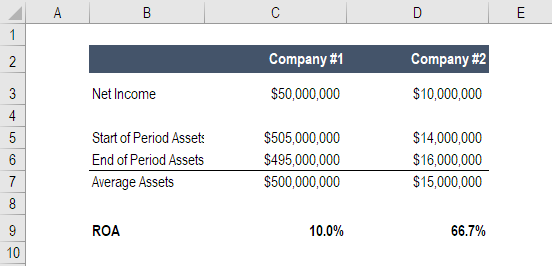

Return on Assets Formula. Two main important elements of this ratio are Net Profits and Shareholders Equity. Either formula can be used to calculate the return on total assets.

Read more profitability ratio Profitability Ratio Profitability ratios help in evaluating the. Its important to keep in mind that the return on sales ratio formula does not take into account non-operating activities like financing structure and taxes. Return on Assets - ROA.

Again we have used average total assets as significant salepurchase of the asset might impair our assessment for the matric. These ratios represent the financial viability of the company in various terms. Debt Ratio 075 or 75.

This ratio is also dependent on the sector and. You need to provide the two inputs ie Net Sales and Average Total Assets. Lets have a look at its formula.

A ratio below 10 indicates that the company has less debt than. For example if an investor is calculating a companys 2015 return on assets the beginning and ending total assets for that year should be averaged. Asset Turnover Ratio Formula in Excel With Excel Template Here we will do the same example of the Asset Turnover Ratio formula in Excel.

There are diverse opinions on what to take in the numerator of this ratio. Return on Equity ROE is one of the Financial Ratios use to measure and assess the entitys profitability based on the relationship between net profits over its averaged equity. Return on assets ROA is a measure of how efficiently a company uses the assets it owns to generate profits.

RONA can be used to discern. This information is valuable to a companys owners and management team and investors because it is an indication of how well the company uses its resources and assets to generate a profit. You can easily calculate the Asset Turnover Ratio using Formula in the template provided.

You must calculate the return on total assets based on the information below and conclude if the companys Profitability ratios help in evaluating the ability of a company to generate income against the expenses. Debt Ratio Total Liabilities Total Assets. Sometimes called return on investment ROI.

In other words a company that has a small dollar amount of assets but a large amount of profits will. Return on net assets RONA is a measure of financial performance calculated as net income divided by fixed assets and net working capital. Rate of return on sales formula Revenue - Expenses Profit 600000 - 500000 100000 Profit Revenue Return on Sales ROS 017 x 100 17.

ROA gives a manager investor or analyst an. When using the first formula average total assets are usually used because asset totals can vary throughout the year. Just like the return on assets ratio a companys amount of assets can either hinder or help them achieve a high return.

Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assetsThis ratio indicates how well a company is performing by comparing the profit its generating to the capital its invested in assetsThe higher the return the more productive and. Debt Ratio 15000000 20000000. ROA Formula Return on Assets Calculation.

Return on Assets Formula EBIT Average Total Assets. Activity ratios measure the relative efficiency of a. Return on assets ROA is an indicator of how profitable a company is relative to its total assets.

Operating Return On Assets Ratio Plan Projections

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

What Is The Return On Total Assets Ratio Bdc Ca

Return On Assets Roa Double Entry Bookkeeping

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Return On Assets Roa Formula Calculation And Examples

0 Response to "Return on Assets Ratio Formula"

Post a Comment